College Accounting 15th Edition Chapter 2 Analyzing Business Transactions Notes

Ch. 1 Accounting: The Language of Business

Ch. 2 Analyzing Business Transactions

Ch. 3 Analyzing Business Transactions Using T Accounts

Ch. 4 The General Journal and the General Ledger

Ch. 5 Adjustments and the Worksheet

Ch. 6 Closing Entries and the Postclosing Trial Balance

Ch. 7 Accounting for Sales and Accounts Receivable

Ch. 8 Accounting for Purchases and Accounts Payable

Ch. 9 Cash Receipts, Cash Payments, and Banking Procedures

Ch. 10 Payroll Computations, Records, and Payment

Ch. 11 Payroll Taxes, Deposits, and Reports

Ch. 12 Accruals, Deferrals, and the Worksheet

Ch. 13 Financial Statements and Closing Procedure

Ch. 14 Accounting Principles and Reporting Standards

Ch. 15 Accounts Receivable and Uncollectible Accounts

Ch. 16 Notes Payable and Notes Receivable

Ch. 17 Merchandise Inventory

Ch. 18 Property, Plant, and Equipment

Ch. 19 Accounting for Partnerships

Ch. 20 Corporations: Formation and Capital Stock Transactions

Ch. 21 Corporate Earnings and Capital Transactions

Ch. 22 Long-Term Bonds

Ch. 23 Financial Statement Analysis

Ch. 24 The Statement of Cash Flows

Ch. 25 Departmentalized Profit and Cost Centers

Ch. 26 Accounting for Manufacturing Activities

Ch. 27 Job Order Cost Accounting

Ch. 28 Process Cost Accounting

Ch. 29 Controlling Manufacturing Costs: Standard Costs

Ch. 30 Cost-Revenue Analysis for Decision Making

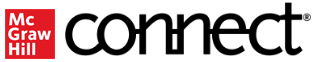

By prompting students to engage with key concepts, while continually adapting to their individual needs, Connect activates learning and empowers students to take control resulting in better grades and increased retention rates. Proven online content integrates seamlessly with our adaptive technology, and helps build student confidence outside of the classroom.

Learn more

SmartBook® 2.0

Available within Connect, SmartBook 2.0 is an adaptive learning solution that provides personalized learning to individual student needs, continually adapting to pinpoint knowledge gaps and focus learning on concepts requiring additional study. SmartBook 2.0 fosters more productive learning, taking the guesswork out of what to study, and helps students better prepare for class. With the ReadAnywhere mobile app, students can now read and complete SmartBook 2.0 assignments both online and off-line. For instructors, SmartBook 2.0 provides more granular control over assignments with content selection now available at the concept level. SmartBook 2.0 also includes advanced reporting features that enable instructors to track student progress with actionable insights that guide teaching strategies and advanced instruction, for a more dynamic class experience.

Learn more

How to Access Instructor Tools for your Course

Your text has great instructor tools – like presentation slides, instructor manuals, test banks and more. Follow the steps below to access your instructor resources or watch the step-by-step video.

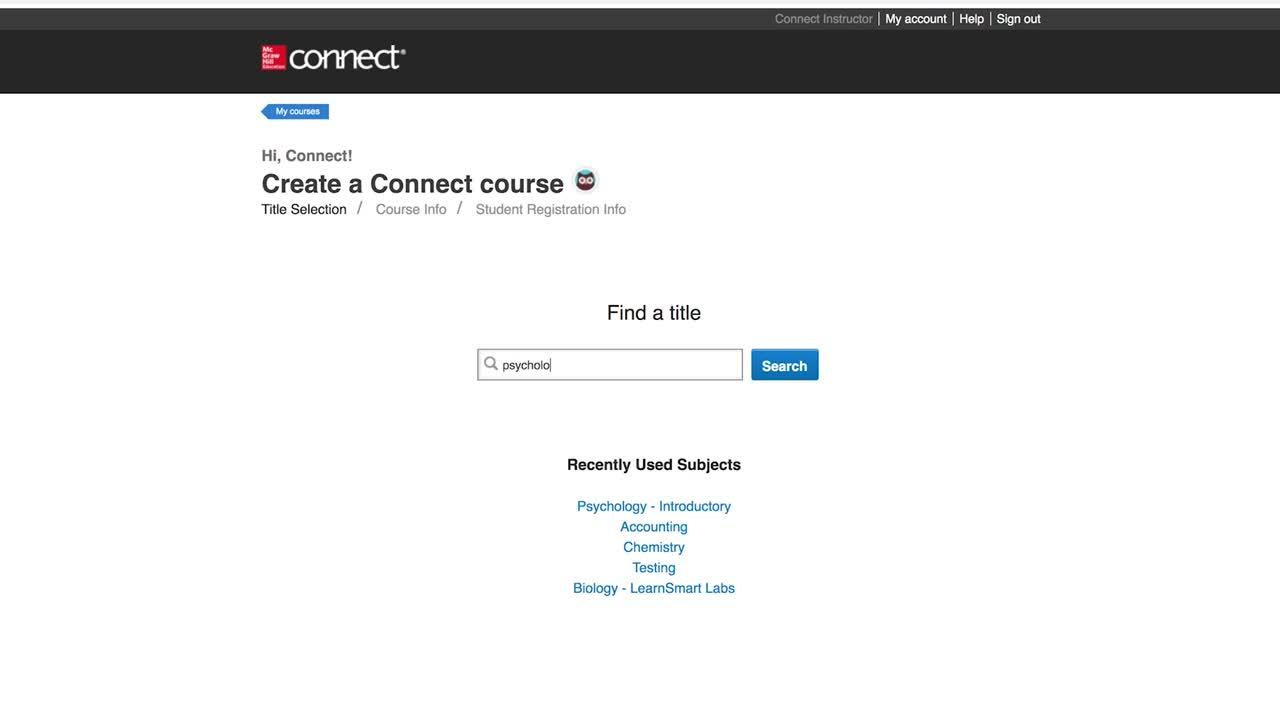

- To get started, you'll need to visit connect.mheducation.com to sign in. (If you do not have an account, you'll need to request one from your MH rep. To find your rep – visit the Find Your Rep page).

- Then, under "Find a Title," you'll search by title, author or subject.

- Select your desired title and create a course. (Note – you do not have to create assignments, just a course instance)

- Then go to your Connect course homepage.

- In the top navigation, select library to access the instructor resources that accompany the title.

Accessibility Rubric

Creating accessible products is a priority for McGraw-Hill. We have put in place processes to make accessibility and meeting the WCAG AA guidelines part of our day-to-day development efforts and product roadmaps.

Please review our accessibility information for this specific product.

In future editions, this rubric will be reformatted to increase accessibility and usability.

McGraw-Hill sites may contain links to websites owned and operated by third parties. These links are provided as supplementary materials, and for learners' information and convenience only. McGraw-Hill has no control over and is not responsible for the content or accessibility of any linked website.

For further information on McGraw‐Hill and Accessibility, please visit our accessibility page or contact us at accessibility@mheducation.com

College Accounting 15th Edition Chapter 2 Analyzing Business Transactions Notes

Source: https://www.mheducation.com/highered/product/college-accounting-chapters-1-30-price-haddock/M9781260247909.html